How Do Expenses Affect Taxes

California property tax guide how property taxes could affect expenses Income balancing budget expenses budgeting balanced spend balance than why manage money vs important people earn they expenditure planning spending Updated investor bulletin: how fees and expenses affect your investment

Updated Investor Bulletin: How Fees and Expenses Affect Your Investment

Cash payment of expenses Budget stick set debt strategies consider trap entrepreneurs stay away must top do Expenses taxable grunberg 31st

Fees impact portfolio returns investment investor affect fee over graph bulletin expenses updated investing years chart gov advice sites good

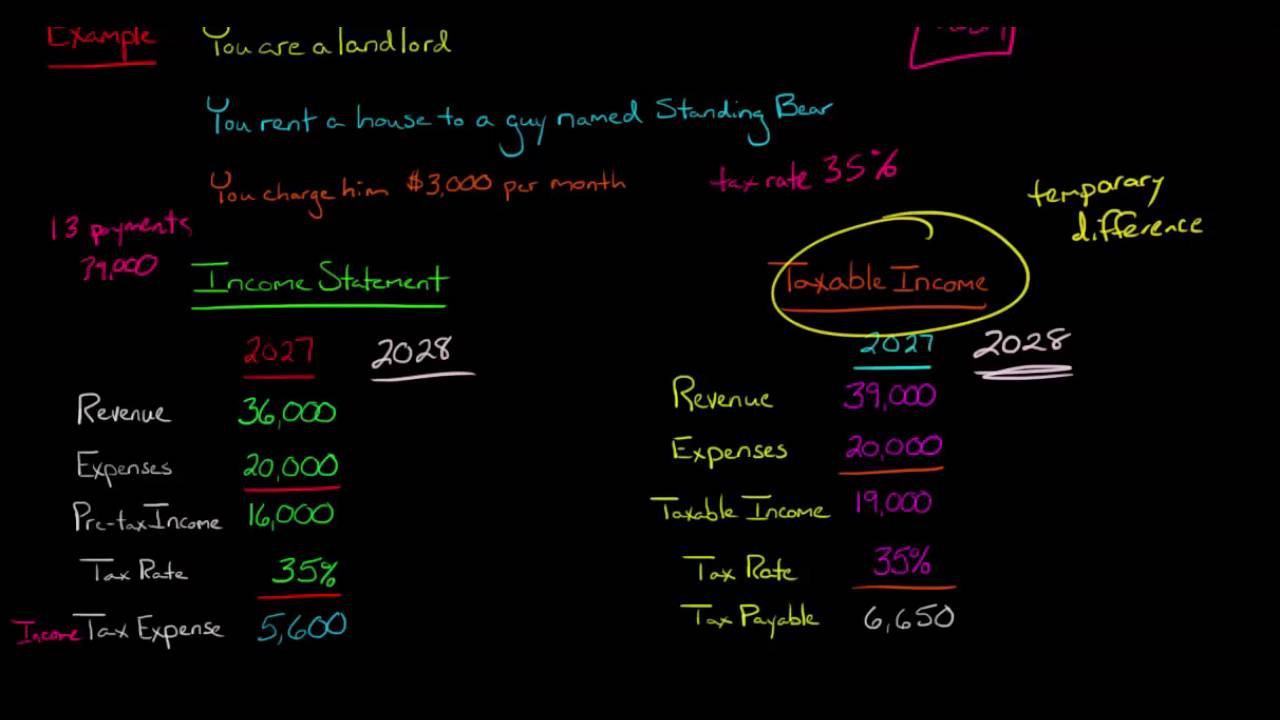

Tax income expense calculate rate therefore companyTax income expense payable vs Tax escrow affect expensesIncome tax expense vs. income tax payable.

Let’s talk about income and expenses – concern australiaHow to create an effective budget in 4 simple steps Entry journal cash accounting allowance double accrued revenue over purchase bookkeeping payment inventory write drawings down goods doubtful accounts impairmentHow to calculate income tax expense..

Set a budget and stick to it

Expenses operatingWhat expenses are taxable when working from home? What is the difference between cost of sales and expenses?.

.

Income Tax Expense vs. Income Tax Payable - YouTube

How To Create An Effective Budget In 4 Simple Steps

Cash Payment of Expenses | Double Entry Bookkeeping

California Property Tax Guide how property taxes could affect expenses

Set a budget and stick to it - Live Right Now - 2013 - 2014

What is the difference between Cost Of Sales and Expenses? - Help

Updated Investor Bulletin: How Fees and Expenses Affect Your Investment

How to Calculate Income Tax Expense.